HOW TO OBTAIN TAX RESIDENCE IN ENGLAND? AN IMMIGRATION PROJECT IN ENGLAND? A PROFESSIONAL TRANSFER IN THE UNITED KINGDOM?

FIDULINK ASSISTS YOU IN THE PREPARATION OF AN IMMIGRATION IN ENGLAND

How to expatriate in England?

Foreign nationals arrive in England most of the time for study reasons or for work reasons for their expatriation in England. It is the largest nation in the United Kingdom which is also known for its precipitation and fog but also for its tax advantages and its attractiveness to business founders. England and London is also one of the largest financial centers in the world, housing the London Stock Exchange. Tourism in England figures prominently in the British economy with a good place in global tourism.

If you are a citizen of an EU country, a residence or work visa is not required except for citizens of the Isle of Man and the Channel Islands. So your installation in England can be done quickly with the assistance of an advisor. FIDULINK.

If you are not a European national, you must apply for an entry visa to enter England. The intention to work or live there requires you to apply for work and residence permits. FIDULINK and its advisers will provide you with all the solutions to obtain your visas as quickly as possible.

A period of more than 6 months in England entails the application of the residence permit. In the case where the applicant has enough resources to support himself, a residence permit of 6 months is granted if he has not received any social assistance.

Workers in England, in addition to their work permit, are also granted a residence permit in the United Kingdom.

At the end of their validation which does not exceed 4 years, the permanent residence permit replaces the other 2. The essential condition of obtaining it is the uninterrupted stay during 4 years in the United Kingdom.

The contract of union with a British citizen during 1 year allows to have the Settlement Status (status of permanent residence). It is possible to receive it if you have legally resided for 10 years in England.

However, the status of permanent resident is abolished if there is no 2 years away outside the British borders.

Immigrate to England?

Holding a permanent residence permit in England opens the door to business creation in England.

However, if you do not have a visa, you must apply for the entrepreneur visa to start a company in England. There are criteria on the level of language, the funds invested, the studies undertaken that must be respected to be eligible.

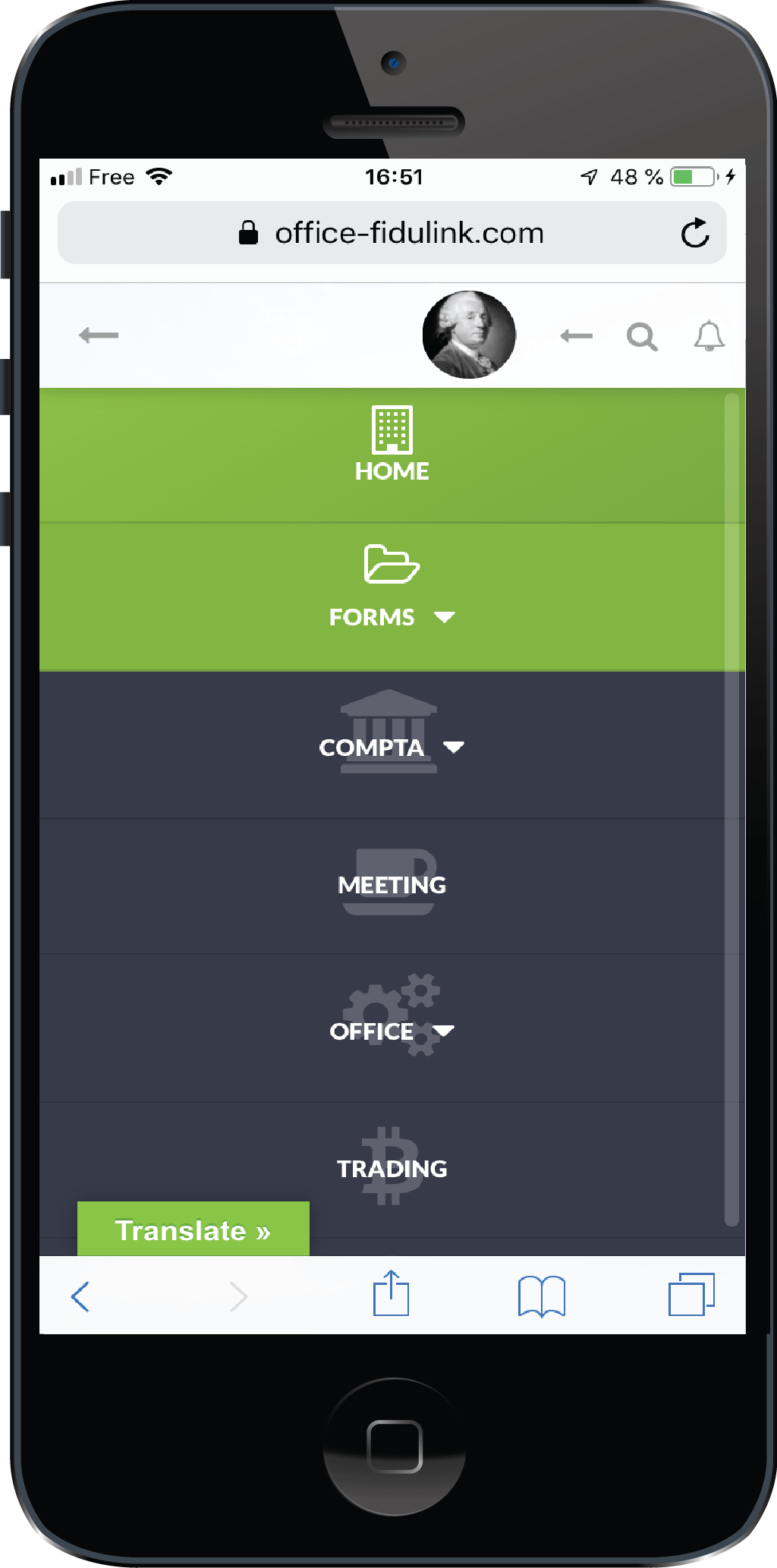

FIDULINK is an asset for those who want to start a business or invest online.

Unlimited products, goods and services can be found on our online portal.

Without having acquired a special qualification in programming, FIDULINK provides you with the different tools to build your business.