You are an actor in the financial world, you have experience in the financial field, and you want to open your own EMI (Electronic Money Institution). We can help you get everything you want. Our FIDULINK service has developed special EMI (Electric Money Institution) solutions.

Here are the services that we offer you, to be completely autonomous as soon as you obtain your license.

Our Firm specializes in company formation in Lithuania for entrepreneurs from all over the world. With our experience of more than 10 years of company creation services, we facilitate the life of entrepreneurs, offer effective and fast professional care in various commercial and financial operations for local and foreign companies. We can also provide legal assistance to our clients for the development and implementation of new business in Lithuania.

Our areas of practice are: Formation of companies; Accounting department (partner); Service Secretary to carry out all administrative procedures; Mergers and Acquisitions; Dissolution; Banking introduction through our network of banking partners; Electronic Money License, Payment Institution License; Licensed Exchange Operator and Cryptocurrency Wallet Provider.

In this article, we are going to talk about the different services that FIDULINK offers for all entrepreneurs interested in starting their own payment institution.

- Why choose Lithuania to create its Electronic Money Institution (EMI)?

- Why choose Fidulink for the creation of your electronic money institution?

- Step I: Incorporation of your UAB (Liability Company) Limited in Lithuania

- Step II: Preparation of documents in accordance with the application for an Electronic Money Institution license in Lithuania

- Step III: Representation by a FIDULINK lawyer throughout the procedure for obtaining the payment license

Interested in our solutions, read on… We would be delighted to accompany you now to obtain authorization as an EMI (Electronic Money Institution)

You can contact us directly by email agent@fidulink.com or visit our website www.fidulink.com

Why choose Lithuania as the country of registration of its Electronic Money Institution

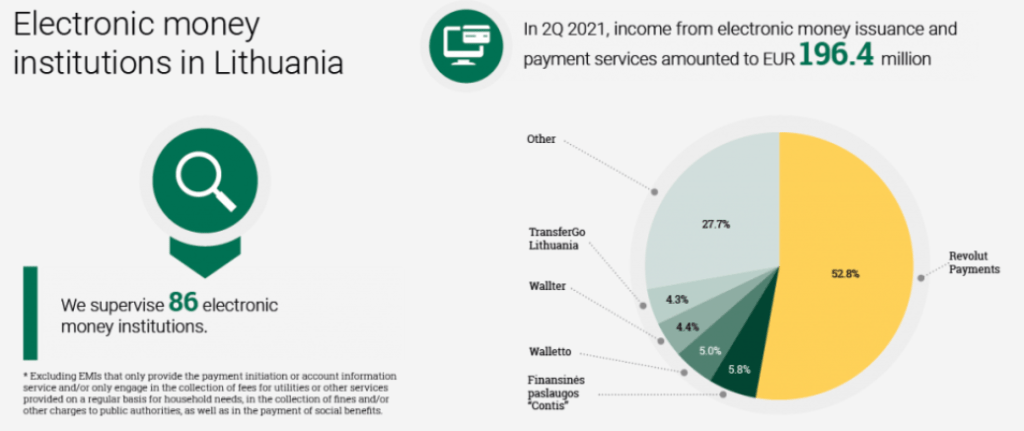

Lithuania is now becoming the first hub in terms of the number of electronic money institutions in Europe, and it wants to become the first fintech hub in Europe. This is the place to be. This is the exact place to be.

Our service is international, we have seen through experience that there are more difficulties in obtaining a license in other countries of the European Union, the jurisdictions (countries) hesitate and give the authorizations to the most experienced, despite the requirements, if the file is complete and compliant. The reasons for this hesitation concerns the lack of qualified personnel in jurisdictions other than Lithuania to supervise EMIs (Electronic Payment Institutions).

In Lithuania, the file is similar to those requested in other countries, which are quite complex, however we are here to relieve you of this time-consuming task. We take the thorn out of your hand, because we know the procedure inside out.

Step I Constitution of your UAB company (liability company in Lithuania)

230

is the number of Fintechs created at the end of 2020

1er

Lithuania is the largest hub in Europe in terms of licensed business

45%

of Fintechs surveyed experienced revenue growth of more than 50% in 2020.

We are present to accompany you from the creation of your company, here is the package that we propose for the creation of your Electronic Money Payment Institution.

- Consultation on registering your UAB in Lithuania

- Preparation of the power of attorney (power) to represent you throughout the process of incorporation of your UAB company in Lithuania

- Formation and verification of the set of documents necessary for the registration of your UAB company in Lithuania

- Opening of an accumulative account (escrow account) for the capital deposit (2500 €) to be made by the client, the sum is blocked until the current account of your UAB company is opened in Lithuania

- Obtaining certificate of capital deposit upon payment of capital by the client

- Preparation and filling of all necessary documents for the Selection of economic activities according to the central register in Lithuania

- Registered address 1 year (legal head office address) of your UAB company in Lithuania

- Representation of the client at the notary, Travel to the notary, signature of the statutes on your behalf thanks to the power of attorney provided*

- Notary fees (according to minimum capital of €2500) Higher capital additional notary fees payable by you

- Representation of the client in court (register), with POA*

- Government fees for incorporating your UAB company in Lithuania

- Representation of the client at the bank – Assistance Bank introduction – Travel opening of bank account with POA. if option chosen

- Electronic company documents (pdf) of your UAB company in Lithuania

- A dedicated agent for 1 year

Step II: Preparation of the complete file in accordance with the license application to authorize your Electronic Money Institution (EMI) in Lithuania

To inform you about the different types of companies with an Electronic Money License, please read our article on the subject by clicking on the button below:

With the PREMIUM option, from FIDULINK, we take care of everything, the preparation of the file in accordance with the license request and your project. Thanks to several interviews and questionnaires, we write the specific file of your UAB company for obtaining the license application to become an institution of Electronic Money in Lithuania, here are the documents that we prepare for you which are included in the set of documents compliant with your EMI project and compliant with the EMI license application in Lithuania.

How is the procedure for obtaining an EMI (Electronic Money Institution) license in Lithuania?

Authorization of an electronic money institution (EMI)

The Law of the Republic of Lithuania on Electronic Money Institutions (hereinafter the "Law") provides that "electronic money" means monetary value represented by a claim on the issuer which is issued upon receipt of monetary funds (hereinafter referred to as "funds") by the electronic money issuer of a natural or legal person and has the following characteristics:

- stored electronically (including magnetically);

- is issued for the purpose of carrying out payment transactions;

- is received by persons other than the issuers of electronic money.

In order to accept money from customers in the electronic domain and hold it in payment accounts for a relatively long period of time, issuing electronic money and then cashing it in, one must first become an issuer. of electronic money. (this can only be done by credit institutions, electronic money institutions (EMIs) and certain other institutions).

It should be noted that the law provides that EMIs are allowed not only to issue electronic money in the Republic of Lithuania and/or other Member States, but also to provide the services specified in Article 5 of the Law of the Republic of Lithuania on payments (provision of payment services, e.g. issuance and/or acquisition of payment instruments, money transfers and other services). For this reason, an EMI (Electronic Money Institution) in Lithuania differs from a payment institution in that an EMI (Electronic Money Institution) in Lithuania can hold customer funds, while payment institutions cannot.

Authorization of an electronic money institution to carry out restricted activities in Lithuania

In order to establish a favorable environment for Lithuanian and foreign startups, a special project of Licensing EMI (Electronic Money Institution) in Lithuania to engage in restricted activities has been implemented with the aim of facilitating the access of new participants in the Lithuanian market and later, after obtaining a license to engage in regular business, in the European Economic Area market as well. The fundamental difference between an EMI (Electronic Money Institution) carrying out restricted activities and a traditional EMI is that the EMI carrying out restricted activities is not subject to the minimum initial capital requirement; however, a license of an electronic money institution to engage in restricted activities is only valid in the Republic of Lithuania. To obtain an EMI license, you must have a capital of 350 euros; however, this license authorizes the provision of electronic money issuance and redemption, distribution and payment services in other EU member states as well as after following a notification procedure.

Authorization process

The Bank of Lithuania's approach to the licensing process for EMIs, as well as other institutions, is as open as possible and normally begins long before a license application is submitted to it. We encourage all applicants who are actively seeking an EMI license to contact us as soon as possible so that we can discuss their planning process and help determine which financial services should be licensed. This allows us to more clearly explain the authorization process and what it means, our requests, requirements, expectations and any other major aspects that may affect the authorization process.

Legal deadline

The laws provide that an application for IME approval must be assessed within: 1) 7 months to 1 year months from the presentation of the appropriate and sufficiently informative documents; 2) when all the documents have not been submitted or have been submitted with deficiencies, within an additional period of 3 months after the submission of the additional documents and information required by the control service.

First meeting with representatives of the Bank of Lithuania

The Bank of Lithuania, knowing that the legal acts governing the licensing process may not always be clear to newcomers to the financial sector and experienced EMI specialists, encourages applicants for an EMI license to contact the Bank from Lithuania. Lithuania at an early stage. The Bank will provide more detailed information on the authorization process and requirements for potential (existing) IMEs.

The representatives of the companies who took part in the pre-tender meetings with the representatives of the Bank of Lithuania repeatedly underlined the advantages of these meetings, since they not only made it possible to obtain answers to the questions that arise, but also to get in direct contact with specialists from the Bank of Lithuania. The purpose of the initial meeting is to answer any questions that may have arisen at the pre-application stage and to find out what licensed financial services the applicant plans to provide or what type of license they should apply for. Participants in these meetings usually include at least two specialists from the Bank of Lithuania's Supervisory Department (who usually answer questions about the licensing process); however, any other, e.g. technical specialists may also be required to attend.

During the pre-application meeting, the Bank of Lithuania aims to discuss the following points:

- Who is the applicant and what type of entity is it?

- Who are the owners and/or major capital investors and what is their country of origin?

- How advanced or developed is the applicant's proposal? In some cases, it may be too early to have a meeting.

- Is the candidate part of a larger group?

- Who will be responsible for managing the business?

- The applicant's funding model.

- Details of the products/services, target markets, distribution channels, pricing policy and related regulated activities that will be requested.

- Sources of funding for the EMI (Paying Institution).

- Planned staffing levels.

- Main outsourcing provisions.

We believe the process works well if the above information is provided to us in the form of a presentation before the first meeting. We therefore invite potential candidates to answer all the above questions before the scheduled meeting, i.e. to check whether all the necessary information has been collected in order to be able to express themselves in detail on this subject and also be ready to be challenged on all aspects of their projects. .

Key requirements for an EMI (Electronic Money Institution) to be established or authorized

Considering that at the time of authorization, Considering that at the time of authorization, the EMI (Electronic Money Institution) created or authorized must be ready to comply with all the requirements imposed on it, as an operational EMI (Electronic Money Institution), the Bank of Lithuania requests that the data details are already submitted at the time of application.

Nevertheless, when evaluating the critical aspects that can determine the authorization of an IME, the following basic elements can be distinguished:

Adequacy of the documents submitted: the documents submitted must comply with the requirements of the legal acts regulating the activities of the EMI and their control; all correct data established in the legal acts or requested in addition must be submitted;

compliance with minimum capital requirement for EMI (Electronic Money Institution): According to the provisions of the Law of the Republic of Lithuania on Electronic Money and Electronic Money Institutions, an EMI must have a minimum initial capital of at least EUR 350 and an EMI (Electronic Money Institution) carrying out restricted activities is not subject to this requirement. The average outstanding balance of the last 000 months of electronic money of the EMI (Electronic Money Institution) to which a payment institution license for restricted activities has been issued (when no activity is exercised, projected in a plan of business) may not exceed 6 euros per month, with the exception of the case provided for in paragraph 900.000 of article 7 of the law. If this limit is exceeded, the institution must, within 12 days of discovering this fact, apply to the Bank of Lithuania for the granting of an EMI license for unlimited activities;

The suitability and suitability of the EMI (Electronic Money Institution) and its shareholders or voting rights holders: entities holding a qualifying holding in the authorized capital and/or voting rights of the EMI must be able to ensure the proper management and prudence of the EMI (Electronic Money Institution), have a sufficiently high reputation and be financially sound (the authorization of an EMI (Electronic Money Institution) to exercise restricted activities is not subject to the conditions of good repute and good repute of shareholders or holders of voting rights);

the aptitude and good repute of the managers of an electronic money institution: the managers of an electronic money institution must be of good repute and have the qualifications and experience necessary to perform their duties correctly.

the operating plan must correspond to the possibilities of the founders of the EMI (Electronic Money Institution) (shareholders or holders of voting rights) to implement it, while the future EMI (Electronic Money Institution) must, at the time of approval, be ready to provide financial resource services in a safe and healthy way.

It should be noted that, given the need to ensure sound and prudent management of the EMI (Electronic Money Institution), the EMI must have a detailed procedure for the management of the issuing activity. of electronic money, adapted to the nature, scope and complexity of the activities of the EMI (Electronic money institution), including is an organizational structure allowing to ensure the differentiation of functions and responsibilities both vertically and horizontally with clearly defined, transparent and consistent limits of responsibility, a system for identifying, managing and monitoring risks that have arisen or are likely to arise, a management information system and internal control system, including reliable administrative measures and an accounting system.

Assessment of submitted documents

The process usually involves verification and evaluation by a number of specialists from the control department and other structural units to help form a common opinion and make a decision on the application. During the evaluation period, also take place:

regular communication and meetings with representatives of the candidate company (as needed);

presentation of observations by the control service, according to which the EMI (Electronic Money Institution) must eliminate the material defects noted. Upon request for additional information or data, the decision must be made within 5 months to 1 year (for an EMI license to carry out restricted activities – within 3 to 5 months) after receipt of the additional documents and data.

The duration and level of document review depends on the number of activities the applicant plans to undertake, specified in the operational plan. When the request is not requested for all the services that can be provided under the EMI license, the scope of the data provided must be more limited; therefore, the evaluation could be faster.

All applicants for an EMI license have direct access to Bank of Lithuania specialists, who are experts in the assessment of submitted documents. We are at your disposal to accompany applicants throughout the authorization process, inform them of the progress of the process and aim to ensure a cooperative relationship between the Bank of Lithuania and financial market participants during and after. the authorization process.

Documents and information to be submitted to the Bank of Lithuania in order to obtain an EMI license

In order to receive an EMI license, the company must submit forms with additional documents to the Bank of Lithuania

List of additional documents to be provided:

Our fees to establish its documents (in accordance with the license request and personalized in relation to your project) are 7000.00 €.

The documents you must provide

- Identity documents (Europe) (certified copy of the original)

- Valid passport (certified copy of the original)

- Main residence invoice (electricity, water, internet, account statement, tax notice) (certified copy of the original)

- Mandatory criminal record (to order)

- Shareholder, director and Team Board CVs to be provided

- Compulsory office for the EMI license (we accompany you if necessary quickly with our partner for the quick search of your office)

- A compliance officer

We help you in all the steps to find your office, and your Compliance Officer employee.

*SET OF DOCUMENTS TO BE PROVIDED BY THE CUSTOMER FOR THE LICENSE REQUEST EXCLUDING IDENTITY DOCUMENTS or to be established by FIDULINK agents. *

Preparation of documents to be provided by the customer: PREMIUM PACK ONLY

- Economic model (presentation brochure)

- Financial plan over more than 3 years

- Platform risk mapping, risk assessment by testing your platform as a lead, with demo access provided (including “risk analysis” audit

- Description of the personalized control and permanent procedures related to your activity

- Accounting procedure

- Description of Internet monitoring and control and external functions

- Implementation of internal control mechanisms (to be put in place) to comply with obligations regarding the prevention of money laundering and the financing of terrorism (INCLUDED IN YOUR PACKAGE PROVIDED BY FIDULINK)

- Description of qualifications and experience showing that the indicated person's experience in the fight against money laundering and terrorism (AML compliance officer to be recruited) has posted an advertisement on LINKEDIN. We can draft the ad template to post on your LINKEDIN and we can also post it on our LINKEDIN for further feedback. We indicate your contact details in the ad, you carry out the interviews yourself, we send you the applications received, your follow-up.9. Identification and description of ML/FT risks (Customer risk, Product/service risk, Risk related to service delivery channels, Geographical risk, Other sources of risk)10. Description of the Control of all BC/FT11 risks. Prevention of Money Laundering and Terrorist Financing Handbook for personnel whose duties relate to the implementation requirements of the prevention of money laundering and terrorist financing.

- Technical file Description of the measures to be implemented to ensure adequate staff training in the prevention of money laundering and terrorist financing

- Data sheet | Description of the provisions that will be established to ensure the familiarization of new and existing employees with the systems, procedures, policies and other documents for the prevention of money laundering and the financing of terrorism applicable or recently adopted in the establishment

- Statement to identify a client and/or beneficiary without their physical presence

- Detailed description of the identification of the client (legal person) without its simultaneous physical presence |

- Description of enhanced due diligence and simplified due diligence and ordinary due diligence of a client (natural and legal person)

- Description of Beneficiary Identification Process (UBO)

- Description of suspect identification procedures

- DESCRIPTION OF MEASURES TAKEN (TO BE TAKEN) TO SAFEGUARD USERS' FUNDS

- Step-by-step description of the type of payment services to be provided by completing the table separately for each type of service

- Description of the execution of the service, indicating all interested parties, processing times, scheme of flow of funds and terms of payment.

- Statement as to whether or not the User's funds will reach the Account(s) maintained by the Applicant while providing the Services

23: Full compliance established on site (included in the package):

EMI PROCEDURE LICENSE WITH DOCUMENTS SET 16999.00 € | PREMIUM OFFER 2022 €12

ORDER A COMPANY QUICKLY AND EASILY ON YOUR MARKETPLACE

Establishment of a company in Lithuania or turnkey purchase:

Setting up a business on our MarketPlace takes about 10 minutes. It requires you to create an account and provide information about your business. The process is completely online.

For any validation, please register online, following the instructions, click on the link below:

FIDULINK PREMIUM PACK OFFER (PREMIUM PACK Regulation of Crypto activity + EMI LICENSE IN LITHUANIA included company creation)

OPTION 1: NEW CONSTITUTION

LITHUANIA PREMIUM PACK. 17999.00 € SPECIAL OFFER 2022 13999.00 €

Consultation on the constitution of the UAB file

Training and verification of ALL necessary documents

Buy UAB off-the-shelf or new incorporation

Bank introduction escrow account for capital deposit (new incorporation)

Preparation on and realization of all the documents necessary for the constitution of your new UAB (new constitution option)

Selection of economic activities according to the register

Domiciliation 1 year (legal address)

Notary services

Notary fees (according to minimum capital only)* if capital greater than €2 additional fees to be expected.

Government fee for change or incorporation (depending on option)

Assistance Introduction of bank or change of beneficiary bank depending on option

Electronic business documents (pdf)

A dedicated agent for 1 year

Complete application until obtaining the electronic money establishment license

Government Fees EMI License

Representation of the client throughout the process (physical appointment, travel, request, forms, etc.)

Compliance set included for your website

Set of documents to be provided to the registers * (see list above)

Contact us:

For all additional requests, please visit our website: www.fidulink.com

You can also visit our marketplace: marketplace-fidulink.com

To contact us by email: agent@fidulink.com

Page Tags:

EMI License, Electronic Money Institution License, UAB company in Lithuania, EMI License in Lithuania, Electronic Money Institution License in Lithuania. Specialized Lawyers with EMI license in Lithuania, Specialized Lawyers with Electronic Money Institution license in Lithuania.